Staff Reporter

Diesel Price Slides 8.8¢ to $4.366 a Gallon

[Stay on top of transportation news: Get TTNews in your inbox.]

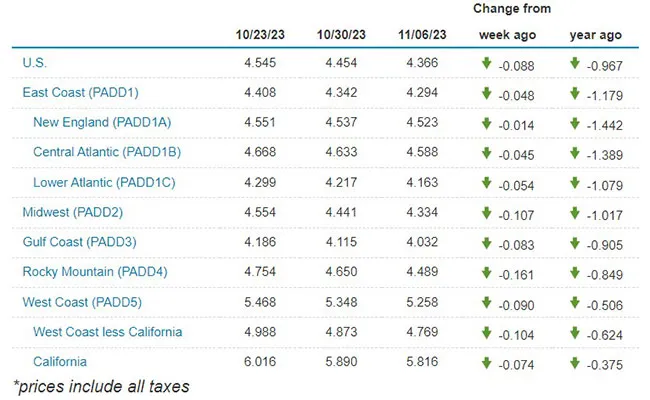

The national average diesel price fell 8.8 cents to settle at $4.366 a gallon, according to Energy Information Administration data released Nov. 6.

Diesel’s average price has dropped a combined 17.9 cents a gallon over the past two weeks after rising 10.1 cents the week of Oct. 23.

A gallon of diesel now costs 96.7 cents less than it did at this time in 2022.

Meanwhile, the average price for a gallon of gasoline slipped 7.7 cents to $3.396 in the most recent week. That’s 40 cents less than a gallon cost at this time a year ago.

U.S. average on-highway #diesel fuel price on November 6, 2023 was $4.366/gallon, DOWN 8.8¢/gallon from 10/30/23, DOWN 96.7¢/gallon from year ago #truckers #shippers #fuelprices https://t.co/lPvRNZG7iO pic.twitter.com/qxCIlbzcxw — EIA (@EIAgov) November 7, 2023

Diesel’s average price fell in all 10 regions in EIA’s weekly survey. The Rocky Mountain area posted the biggest drop at 16.1 cents a gallon. Trucking’s main fuel also shed at least a dime in the Midwest and West Coast less California at 10.7 cents and 10.4 cents, respectively. The smallest decline was again in New England at 1.4 cents.

New England’s relatively firmer tone reflected ongoing supply constraints in the region.

Irving Oil’s 320,000 barrels-per-day Saint John refinery in New Brunswick was only due back from a seven-week turnaround on Nov. 5. Irving Oil was not immediately available for comment on whether the refinery had returned on schedule.

Further near-term retail price weakness is in the cards, analysts say, with wholesale crude and diesel prices plummeting Nov. 6 and 7.

Wholesale crude and diesel prices fell in recent days on the back of Chinese transportation fuel price cuts and fears over demand in both China and the U.S., according to Price Futures Group oil trader Phil Flynn.

Retail prices began the fourth quarter of 2023 averaging $4.593 a gallon. Over the past five weeks, generally the trend has been lower and more of the same can be expected, according to the Department of Energy’s statistical arm.

In its latest Short-Term Energy Outlook, released Nov. 7, the EIA forecast retail diesel prices would average $4.46 per gallon in the final three months of the year, compared with a forecast of $4.57 per gallon a month earlier.

In the first quarter of 2024, EIA now expects retail diesel prices to average $4.38 per gallon, compared with an October prediction of $4.42 per gallon.

Peak shipping season ended in recent weeks, as did peak harvest season in the Midwest, leading to demand sagging.

However, at least one region of the country will start to see a ramp-up in demand — the Pacific Northwest.

U.S. average price for regular-grade #gasoline on November 6, 2023 was $3.396/gal, DOWN 7.7¢/gallon from 10/30/23, DOWN 40.0¢/gallon from year ago #gasprices https://t.co/jZphFa0Ptd pic.twitter.com/A2EKPe5eBi — EIA (@EIAgov) November 7, 2023

Christmas tree shipping season began Nov. 4, according to DAT Analytics & Freight Principal Analyst Dean Croke.

Peak Christmas tree shipping typically occurs in the weeks leading up to Thanksgiving and continues through December, Croke said in a Nov. 6 blog, adding that this coincides with the peak season for fall produce in the Pacific Northwest, including potatoes, onions, pears and apples.

Many of those trees as well as the produce and Thanksgiving meat shipments are transported by refrigerated trucks, with spot rates in the segment rising by almost 5 cents/mile last week, the largest weekly increase since Mother’s Day, said Croke. However, he said, reefer linehaul spot market rates are 16 cents/mile lower than 12 months ago at $1.92/mile.

Despite the wholesale market weakness, some underlying support for diesel prices may also be building on the supply side, say analysts, with refinery utilization rates unlikely to be as high as they did before the fall turnaround season when facilities restart operations — particularly as crack spreads are weakening.

The downside for diesel is also likely to be limited by an increase in fourth-quarter demand expectations.

In Q4, EIA now expects demand for distillate fuel oil, a proxy for diesel, to average 4 million barrels per day, compared with a forecast of 3.97 million barrels a day a month ago, it said.

Demand was higher than expected in the third quarter of 2023 too. Diesel consumption averaged 3.91 million barrels per day in Q3, compared with October’s estimate of 3.80 million barrels per day, the agency said.

U.S. On-Highway Diesel Fuel Prices

EIA.gov

Want more news? Listen to today's daily briefing below or go here for more info: