Intermodal Gains Accelerate; Tops All Freight Over 4 Weeks

This story appears in the May 18 print edition of Transport Topics.

Truck-rail freight shipments reached a milestone in recent weeks by exceeding all other combined U.S. rail shipments for the first time, driven by such factors as a recent surge in international cargo, industry officials said.

Intermodal shipments in the four-week period ended May 9 edged ahead to 1.12 million, or about 8,000 more than total carload freight, based on Association of American Railroads statistics.

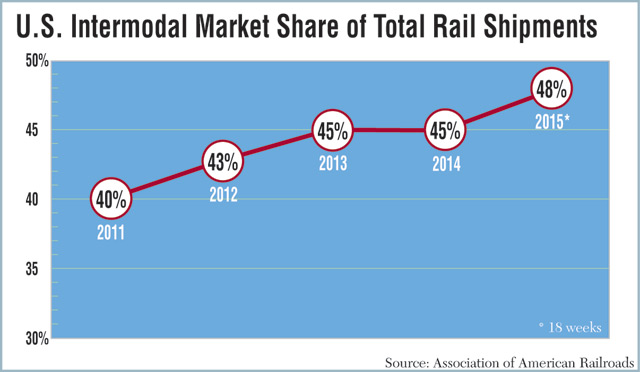

That pace is the latest advancement of a long-term trend. So far this year, intermodal through the first 18 weeks made up 48% of all rail freight. Last year, truck-rail’s shipment share was 45%. When overall rail shipments reached a record in 2006, intermodal was just 38% of the total. The remaining 62% of loads that year primarily were bulk freight such as coal and grain.

Industry experts cited multiple factors for the latest acceleration.

“Shippers want to use the intermodal product,” rail analyst Anthony Hatch told Transport Topics, stressing the importance of the long-term underlying shift to intermodal based on economics and truck driver constraints. “They are worried about trucking capacity now and forever.”

A second reason he and others cited was the pickup in the international intermodal business after the announcement of a tentative contract agreement at West Coast ports.

“[The increase] is probably because they are cleaning out the backlog at the ports,” American Trucking Associations Chief Economist Bob Costello told TT.

“Intermodal in recent weeks is benefiting from an uptick in international intermodal traffic as well as continued conversion of highway freight to rail,” said Robert Salmon, a Deutsche Bank analyst.

Intermodal Association of North America President Joni Casey cited another reason: “Consistently strong domestic container volumes continue to be the growth engine for intermodal business.”

That trade group earlier this month released a first-quarter market trend report that showed domestic container shipments in that period increased 6.5% in North America.

Railroads also are facing a decline in non-intermodal shipments, in tandem with the U.S. economy, several experts noted.

“We aren’t seeing a surge in economic activity to start the second quarter,” AAR Senior Vice President John Gray said in a May 6 statement. “Railroad coal traffic is suffering from reduced electricity generation from coal and lower coal exports. Rail volumes for a number of other commodities are down due to general economic weakness. We hope that turns around.”

“Generally, we expect the U.S. economy to grow,” Salmon said. “Given that carload volumes are derived demand from the broader U.S. economy, especially manufacturing, that could drive carload growth in the aggregate going forward.”

He added that there are “headwinds” in the petroleum and coal sectors that could hold back future increases for energy-related reasons. Rail shipments such as sand have dropped off this year as low crude oil prices have depressed exploration.

At the same time, those low prices for natural gas have prompted some utility plants to switch from coal for power generation, analysts said.

“Rail carload has had some specific issues,” Hatch said, particularly a drop-off in coal traffic that had dipped nearly 10% below last year through May 9. Grain shipments have declined even faster at 13%.

Hatch said he believes the carload freight business could recover, with help from lower oil prices.

“Railroads already have taken the hit for the bad [economic] news,” Hatch said. “Hopefully, they are only beginning to see the good news as consumers begin to feel a little wealthier.”

“We can expect intermodal to take market share from trucks going forward,” Salmon said. “We can expect faster growth from intermodal” relative to carload freight.