Bloomberg News

Biden’s Biofuel Push Risks Dethroning Corn as King of Crops

[Stay on top of transportation news: Get TTNews in your inbox.]

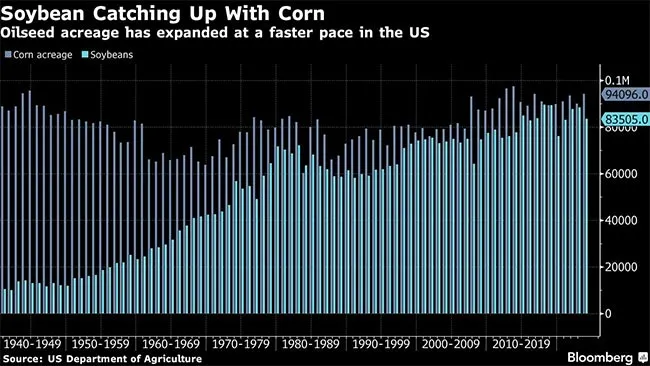

American farmers will plant more corn than soybeans in 2024 — as they have in most years for over a century. But beyond that, a green diesel boom threatens to dethrone the king of all crops.

President Joe Biden’s decarbonization plan and the huge subsidies it offers to green energy are boosting demand for soybean oil, key to renewable diesel production. That means the old adage that the U.S. farmer likes to plant corn could become history, with soy taking the No. 1 spot in the future.

“Most would see a future where that would be the case,” said Paul Maass, CEO of Omaha, Neb.-based crop handler Scoular Co.

The biofuels push has already unleashed a race to build soybean processing plants, with companies including Cargill Inc. and Bunge Global SA planning to expand capacity. The U.S. currently has more than 20 projects to increase the so-called crush, which produces soy oil and meal used in animal feed.

“When you look at all the crush facilities that have been announced and are being built, you’re going to need more acres,” Maass said in an interview at the National Grain and Feed Association’s annual event in Orlando last week.

In addition to booming demand for soybean oil, corn demand has been jeopardized by the proliferation of electric vehicles. More EVs mean less grain ethanol is needed in transportation.

American farmers have planted more soybeans than corn only in two out of more than 100 years. The last time that happened was in 2018, when the soy area exceeded that of corn by a mere 500,000 acres. The other occasion was in 1983, near the beginning of a farm crisis that culminated in relief efforts such as Farm Aid.

To be sure, some remain skeptical about soybeans becoming king.

Many farmers would typically prefer to plant corn because it’s sown earlier in the season and it’s easier to harvest, according to Max Fisher, NGFA chief economist.

“There’s a marginal acre everywhere, and the marginal acre will probably swing toward soybeans as long as the market asks for that,” said Corey Jorgenson, CEO of Shell Rock Soy Processing. “But I don’t think there will be a major structural shift between corn and soybeans because the farmer loves the rotation. That works for soil nutrition — it just works.”

The shift isn’t happening this year. Farmers will likely expand the area cultivated with soybeans by 2.9 million acres to 86.5 million acres, according to the average of analyst estimates compiled by Bloomberg ahead of the U.S. Department of Agriculture prospective plantings report on March 28. That should still fall short of a planned corn acreage of 91.8 million, which is down from last year.

This year’s planned corn acreage is larger than current prices would indicate, according to Jacqueline Holland, an analyst at Informa Plc. Soybean futures have traded in 2024 at an average price that is 2.7 times that for corn, a level that would typically mean it’s more profitable than the grain.

Want more news? Listen to today's daily briefing above or go here for more info

Still, “plentiful on-farm cash reserves, high harvest prices for corn, and affordable input pricing last fall could have locked in 2024 corn acreage before 2023 crops were finished being harvested,” Holland said March 22 in a note to clients.

What’s more, warmer-than-usual spring temperatures — which allow for an earlier planting start — are also preventing roughly 1 million acres of corn from being switched to soybeans this year, according to Curt Strubhar, chairman of Advance Trading Inc. But soybeans seem still poised to become the nation’s No. 1 crop in the longer term, according to the broker.

“It certainly seems to be the way we are headed,” Strubhar said in an interview. “As structured today, renewable diesel planned expansion looks to draw soybean acres away from corn and other crops.”